Amazing Tips About How To Sell A Put

However, as the stock is currently trading above $76.00, one would subtract roughly 1 dollar as the puts are $1 dollar in the money and use that info to place a limit order to sell the june 2019,.

How to sell a put. The profit the buyer makes on the option depends on how far below the spot price falls. Find a stock (or etf) you would like to buy. Find which strike price that you.

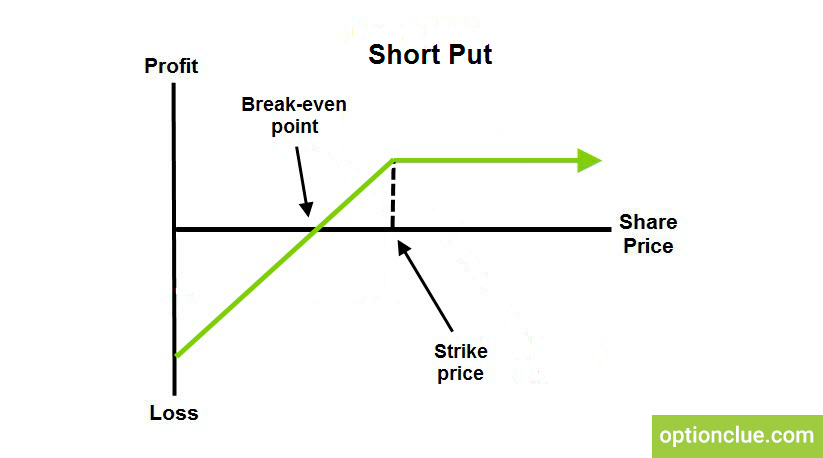

Naked puts in bull markets. Using the powerx optimizer is a great way to. The put seller receives the price, or “premium”, paid for the put.

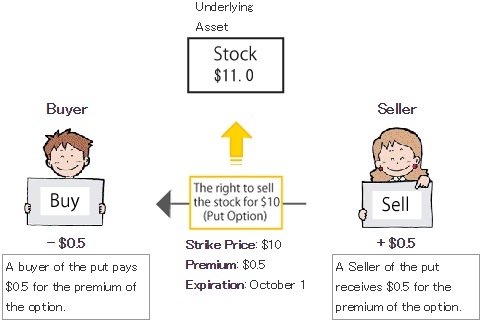

This video goes through the basics of how to execute a sell open put option trade.this channel and this video are for educational purposes only. For example, if stock abc is trading. Since max doesn't own any shares to sell, the put option will initiate a short position at $11.

Yhoo current market price = 49.70. Short puts may be used as an alternative to placing buy limit orders. Look to right of options chain at a put chart.

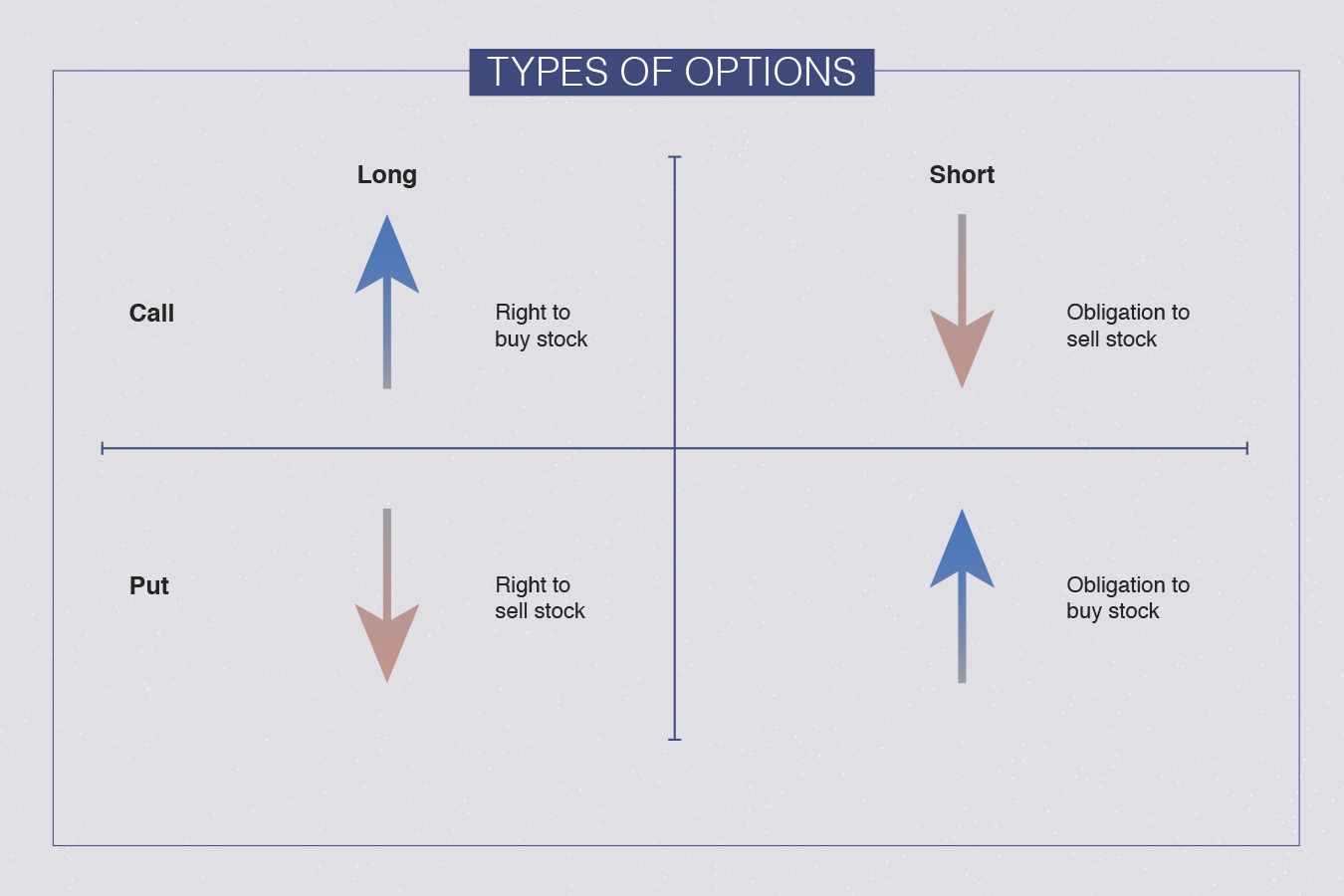

To sell a cash secured put, you’ll do the following. Instead of buying options, investors can also engage in the business of selling the options for a profit. When you sell a put, you receive a profit (your collected premium payment) if the underlying asset's price continues at or above the option's strike price.

To improve your probability of winning in this game, it is far. Write naked calls in bear markets; Determine the price at which you’d be willing to purchase the stock.

A put option gives the buyer the right to sell the underlying asset at the option strike price. 1 day agothe duke of gloucester, a first cousin of the late queen elizabeth, is selling his former manor house. Stay within your risk parameters to avoid a potential margin call.

He can then cover the short position by buying the stock at the current market. I like to use weekly stocks with a delta of 0.3. Bottom line, the sale of put options can be a wise method to produce bonus portfolio income and increase exposure to stocks you would like to own.

Sell a put option with a strike price near your desired purchase price. Trader wants to own 100 shares of yhoo if price goes down to $49. Put sellers sell options with the hope that they lose.

Go to an options chain. If you need help with selling a put contract,. Looking for how to sell put options?

![How To Sell A Put Option - [Option Trading Basics] - Tradersfly](https://tradersfly.com/wp-content/uploads/2019/06/2017-07-27-selling-put-options-single-263.jpg)

/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)

:max_bytes(150000):strip_icc()/ShortSellingvs.PutOptions-eff3cf41a5f549978c295eef47fbc2bd.png)

/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)

![How To Sell A Put Option - [Option Trading Basics] - Youtube](https://i.ytimg.com/vi/WMUKhw_GevA/maxresdefault.jpg)

:max_bytes(150000):strip_icc()/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

:max_bytes(150000):strip_icc()/NakedCallWriting-AHighRiskOptionsStrategy2_2-aab223af50cc44ba9a0f874609356225.png)