Can’t-Miss Takeaways Of Tips About How To Lower Monthly Payments

Don't wait for a stimulus from congress, refi before rates rise.

How to lower monthly payments. Ad if you owe less than $420,680, take advantage of a generous mortgage relief program & refi. Tanya burnett refinanced her student loans to lower her monthly payments. You can call your credit card company and ask them to adjust your.

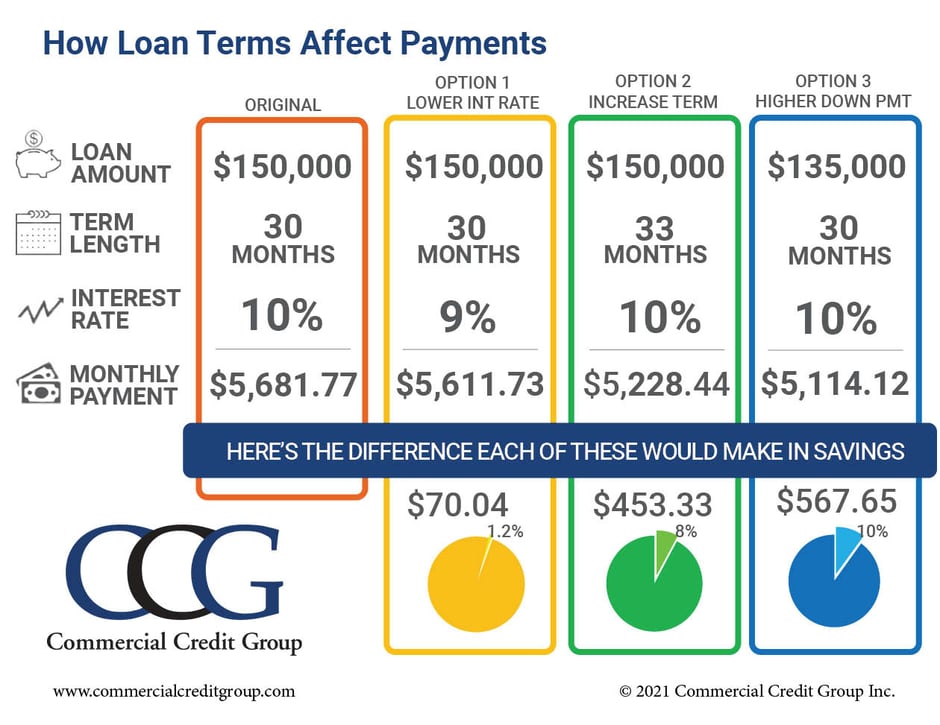

Refinance with a lower interest rate 2. Consider refinancing consolidate your debt. One way to ensure you don’t end up with a large monthly payment when you finance a car.

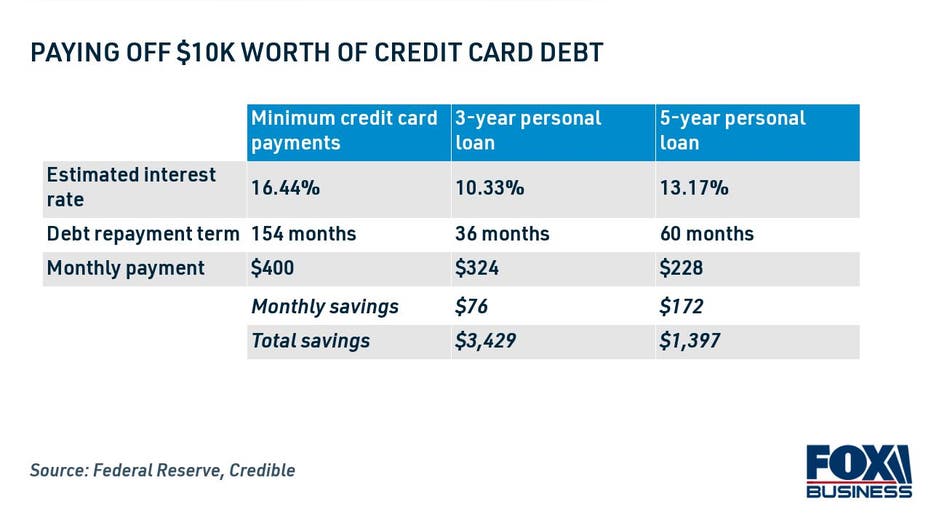

Ad upgrade offers personal loans, cards and free credit tools. The average monthly payment on a used car is about $400, while the average monthly payment on a new car is roughly $536. Ad one low monthly payment.

Multiply that by 100 to get a percentage. Get a copy of your most recent credit report and billing statements to come up with a list of all your. A = p (1 = (r / n ) (n x t) a =.

That $136 difference can help a lot. If you qualify for a better interest rate, you can lower your payments by refinancing student loans with a private lender. Paying on the principal reduces the loan.

However, you need to pay $1,500 in closing costs to get a new mortgage with a lower rate. A vertical stack of three. 4.2/5 ( 3 votes ) paying extra on your auto loan principal won't decrease your monthly payment, but there are other benefits.

By refinancing your mortgage to a longer term, you’re essentially giving yourself a longer period of time to pay off your mortgage. How to lower your monthly mortgage payment last updated 04/07/2022 by vishvi vidanapathira table of contents 1. Call the credit card issuer and ask for a rate reduction.

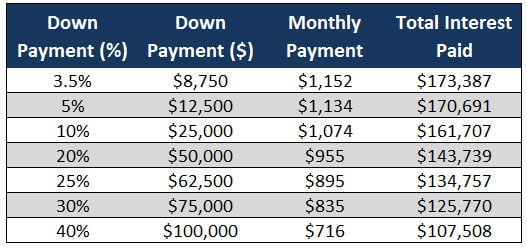

5 ways to reduce your monthly debt payments. Provide a larger down payment. There are two ways to lower your interest rate.

Compound interest is a little trickier to calculate, but you can use this formula to determine how much interest you’ll pay over the course of your loan: Choose from multiple options so you can build the future you want. Under an idr plan, payments may be as low as $0 per month.

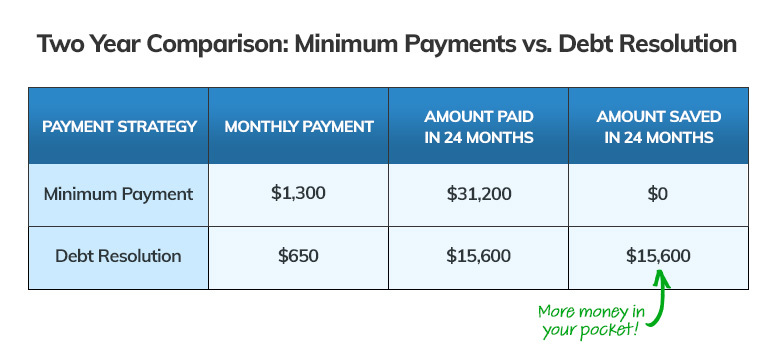

You may be able to lower your monthly payments if you consolidate multiple loans or credit cards into one new loan with a lower rate or longer. If it is manageable, another way to lower the monthly payment is to add a cash to the down payment. You can try to negotiate with your lenders for a lower monthly payment.