Have A Info About How To Avoid Tax On Rental Income

Investors who own rental property can deduct the.

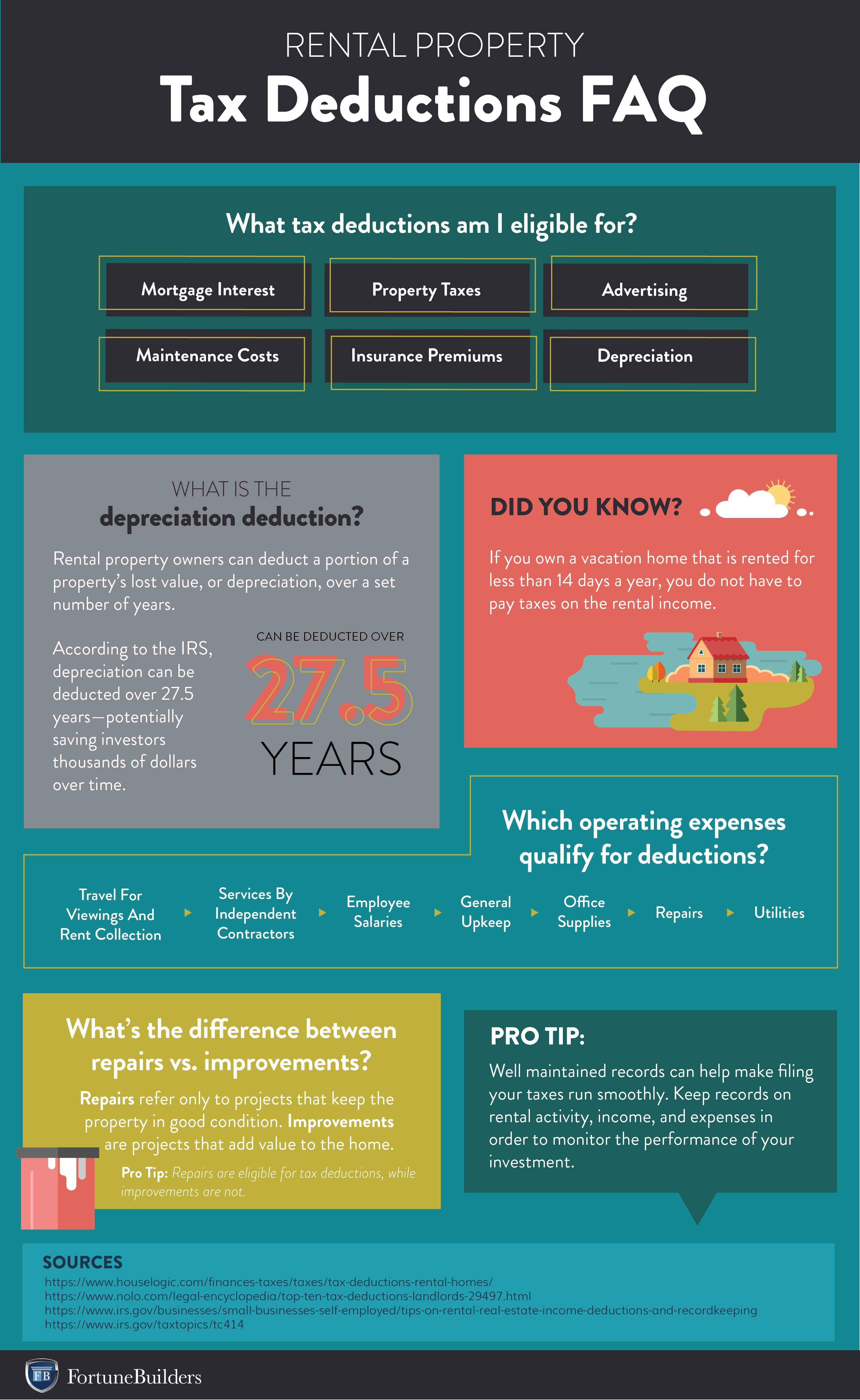

How to avoid tax on rental income. You can't avoid paying tax on your income but you can reduce your tax bill by claiming for some of the expenses (tax relief) which come with renting out property. Report rental income on your return for the year you actually or constructively receive it, if you are a cash basis taxpayer. In general, they use schedule e (form 1040) to report income and expenses.

If you like your rental property enough to live in it, you may be able to convert it into a primary residence to avoid capital gains tax. The income tax of india levies tax on rental income under section 24. Is it worth claiming rental income?

You can avoid paying capital gains tax on an inherited rental property through any of the three methods listed above. You are a cash basis taxpayer if you report income. How can i avoid paying tax on rental income?

You can only claim the part of the interest that relates to the rental property. One of the most popular and easiest ways to avoid taxes when selling rental property is to use the 1031 exchange. How to avoid taxes on rental income.

Investors who own rental property can deduct the costs of maintaining and marketing the property. Selling a rental property can generate healthy profits, but also a significant tax bill. However, there are some rules that the irs.

Purchase properties using your retirement account. If you sell rental or investment property, you can avoid capital gains and depreciation recapture taxes by rolling the proceeds of your sale into a similar type of investment within 180 days. Depreciation alone can allow you to go from owing tax to showing no rental income at all on your taxes, and reducing your tax burden to zero.

The good news is that there are several ways for. If you’re going to take the proceeds to invest in. Such as buying a boat or going on a holiday, you can’t claim the interest on that part of the loan.

You can save tax on rental income by making standard deductions, owning property jointly, and much. (perfect answer) 4 simple ways to reduce taxes as a landlord deducting direct costs. How to reduce or avoid capital gains tax.

With all the deductions available to owners of a rental property, the result of properly reporting income can result in a tax saving. Just make sure that you’re qualified and that the services that they. Convert the property to a primary residence.

How to avoid tax on rental income? If your debt is a big problem, then we highly recommend curadebt’s program.

![Rental Property Tax Deductions: The Ultimate Tax Guide [2021 Edition] - Stessa](https://wp-assets.stessa.com/wp-content/uploads/2019/12/12163600/Group%402x.png)

.jpg?width=560&name=Scott%20Boyar%20Graphics%20(11).jpg)

.jpg?width=560&name=Scott%20Boyar%20Graphics%20(10).jpg)

.jpg?width=560&name=Scott%20Boyar%20Graphics%20(12).jpg)