Ideal Info About How To Reduce Your Overdraft

Pay the amount owed with your credit card.

How to reduce your overdraft. Work out how much you think you can afford to repay each. You can apply for or increase an overdraft limit if: Help & support help with your product overdraft.

This will allow you to limit the intervention. Switch to a credit card. Try reducing the amount you spend each month by.

Cut spending on anything that you can comfortably do without, and get better prices and deals where you can. You can reduce a personal overdraft with us over the phone or in your branch. Next steps 1.) gradually reduce the amount of your overdraft you spend each month.

Credit cards can be a useful way to overcome your overdraft amount. Especially now that overdraft interest rates are. Log in with your nedbank id, app pin or fingerprint.

Though credit cards come with their own challenges, they can also provide a solution to overdraft debt. I have tried to cancel online but i couldn't and i. View or change your details.

2.) repay the balance using credit with a lower interest. You have an eligible natwest bank account which you pay your salary or a regular amount into. Awareness of your balance and pending transactions is the first step to preventing overdrafts.

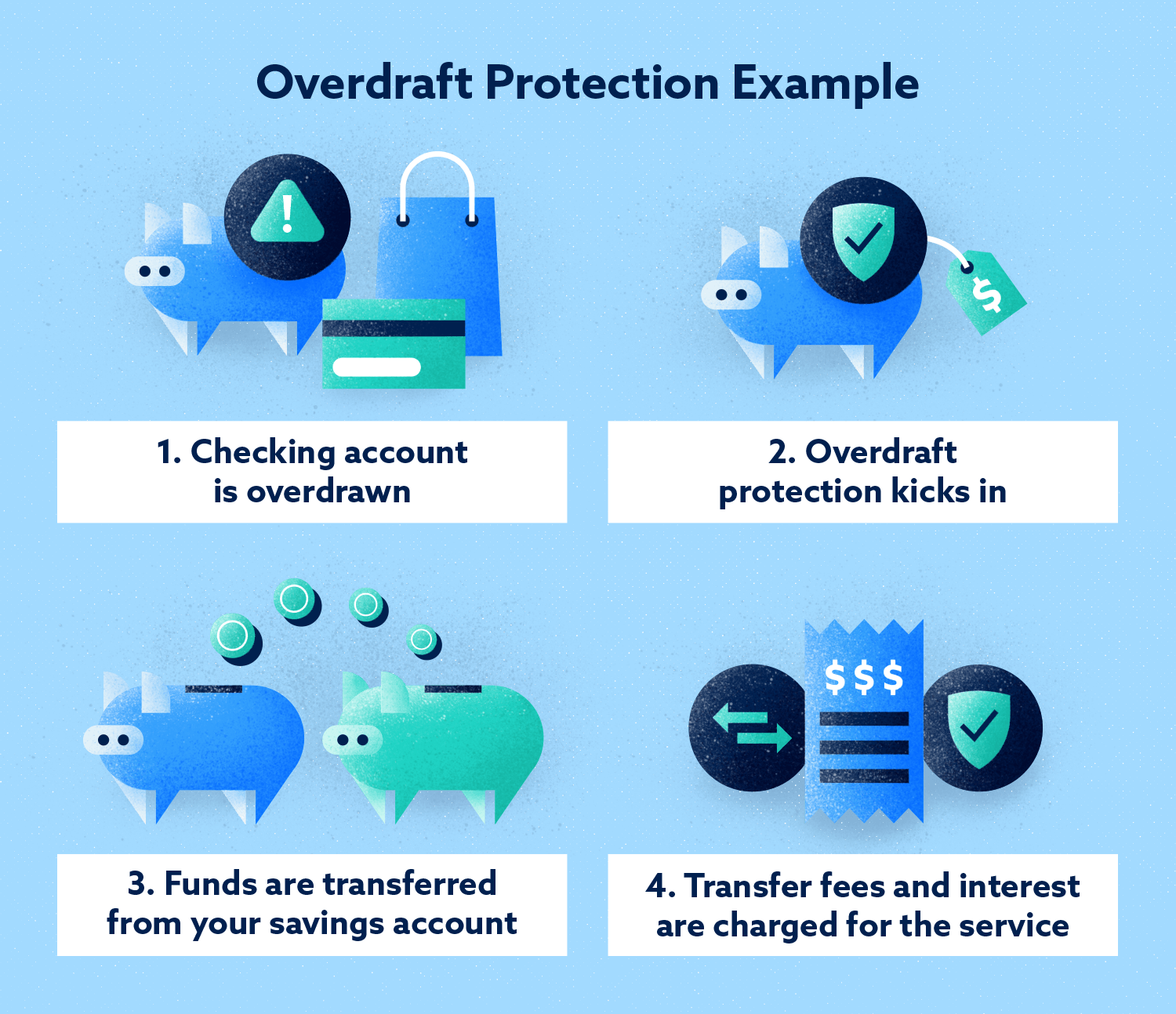

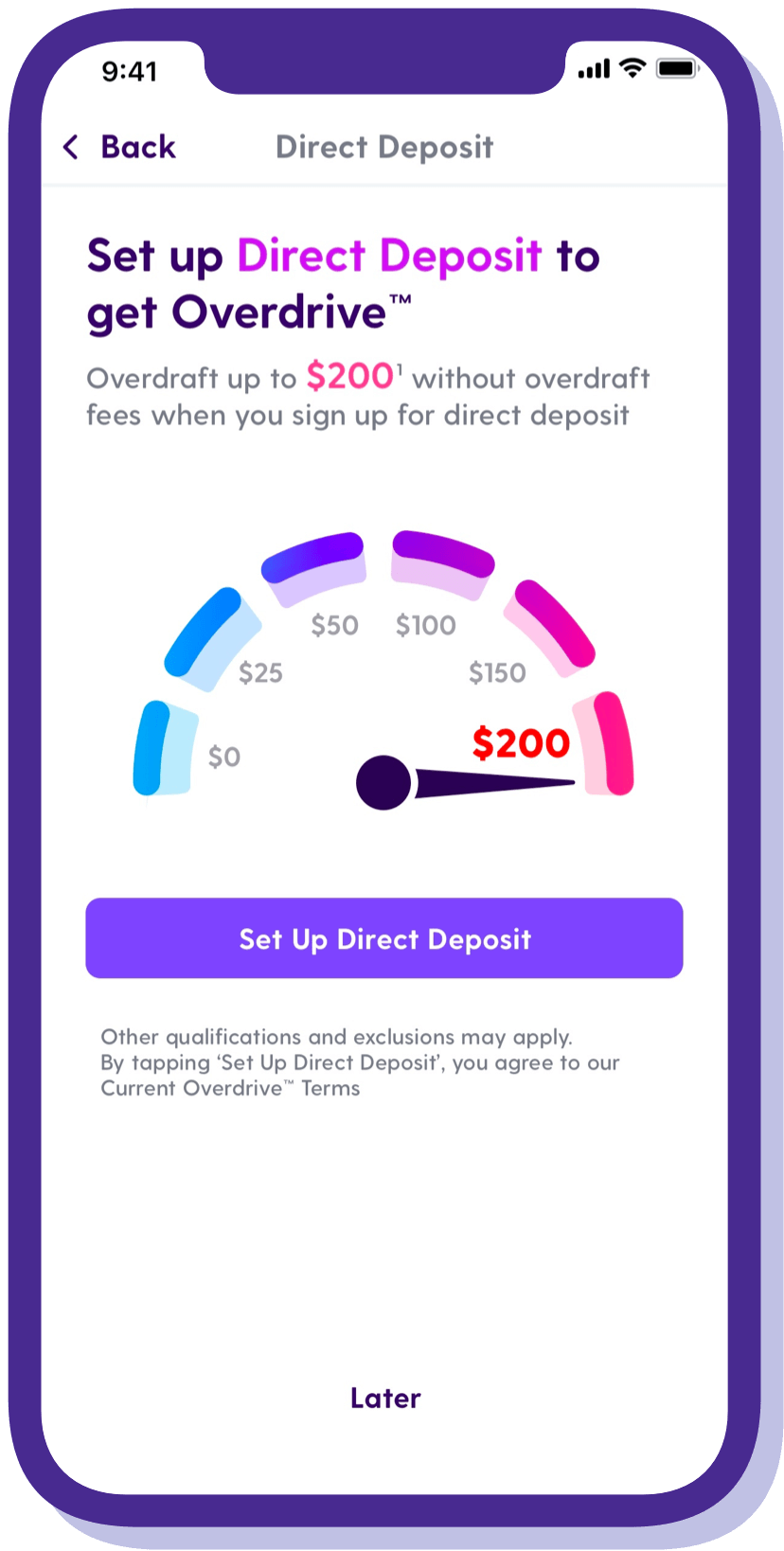

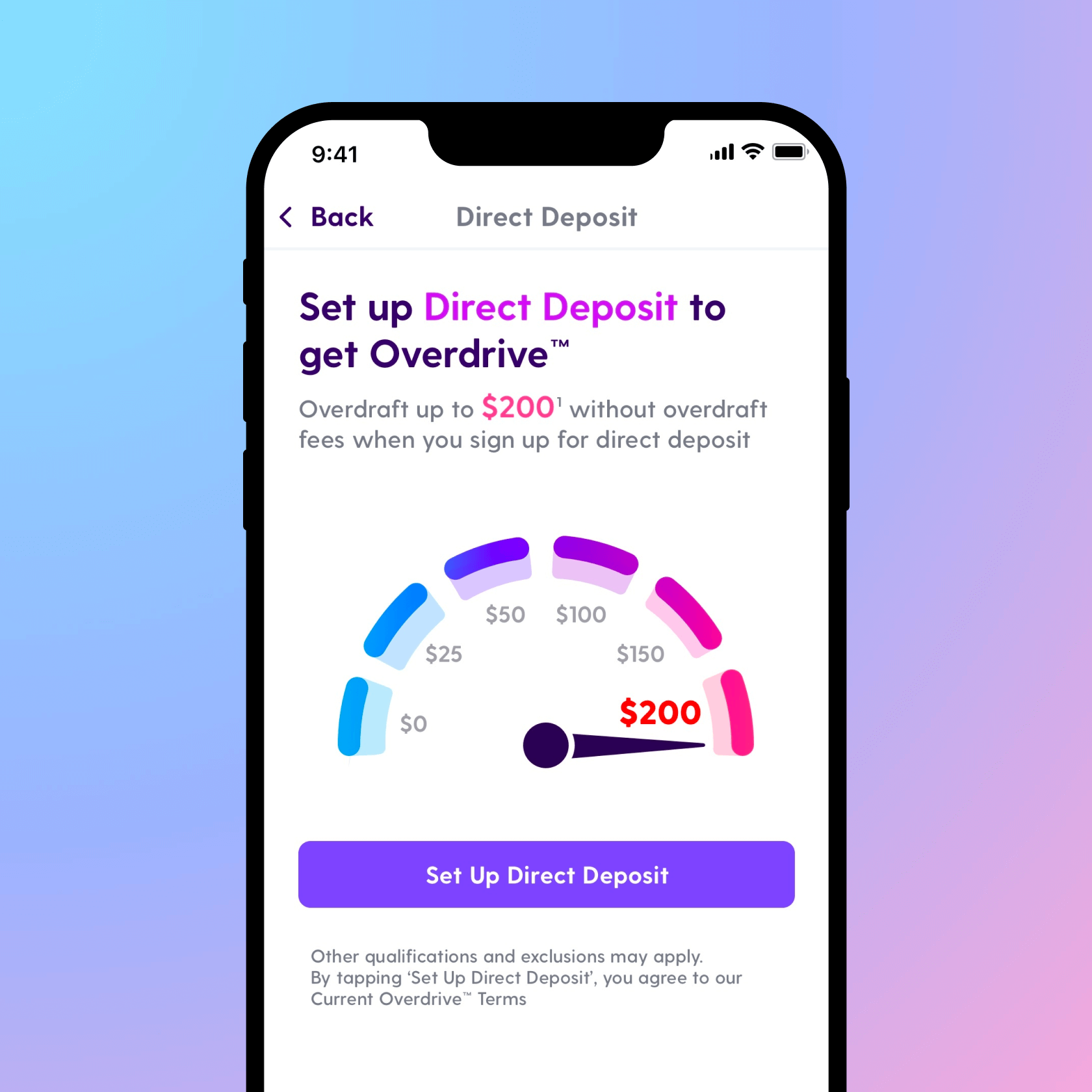

I do not want to have the overdraft anymore and just want to cancel it. If you overdraw your checking account, money will be taken from your linked savings. There are very few of us who would knowingly overdraw our accounts (except in an.

So if you’re paid on the 25th, aim for the 20th. I bank with fnb and i have overdraft on my account. You are aged 18+ and living in the uk.

Ask the companies you pay to shift your direct debits to just before you’re paid. To reduce the costs of overdrafting, link your checking account to a savings account. To reduce an overdraft your account balance must be above what you want your new overdraft.

It is recommended that you negotiate an overdraft authorization, and review the amount occasionally if your income increases.

/dotdash-what-difference-between-overdraft-and-cash-credit-Final-8e1e4594a99342748fc565d7c5dd66d3.jpg)

.png)